(KTTS News) — If you haven’t received your Greene County tax statement, it might be because the county doesn’t know where you live.

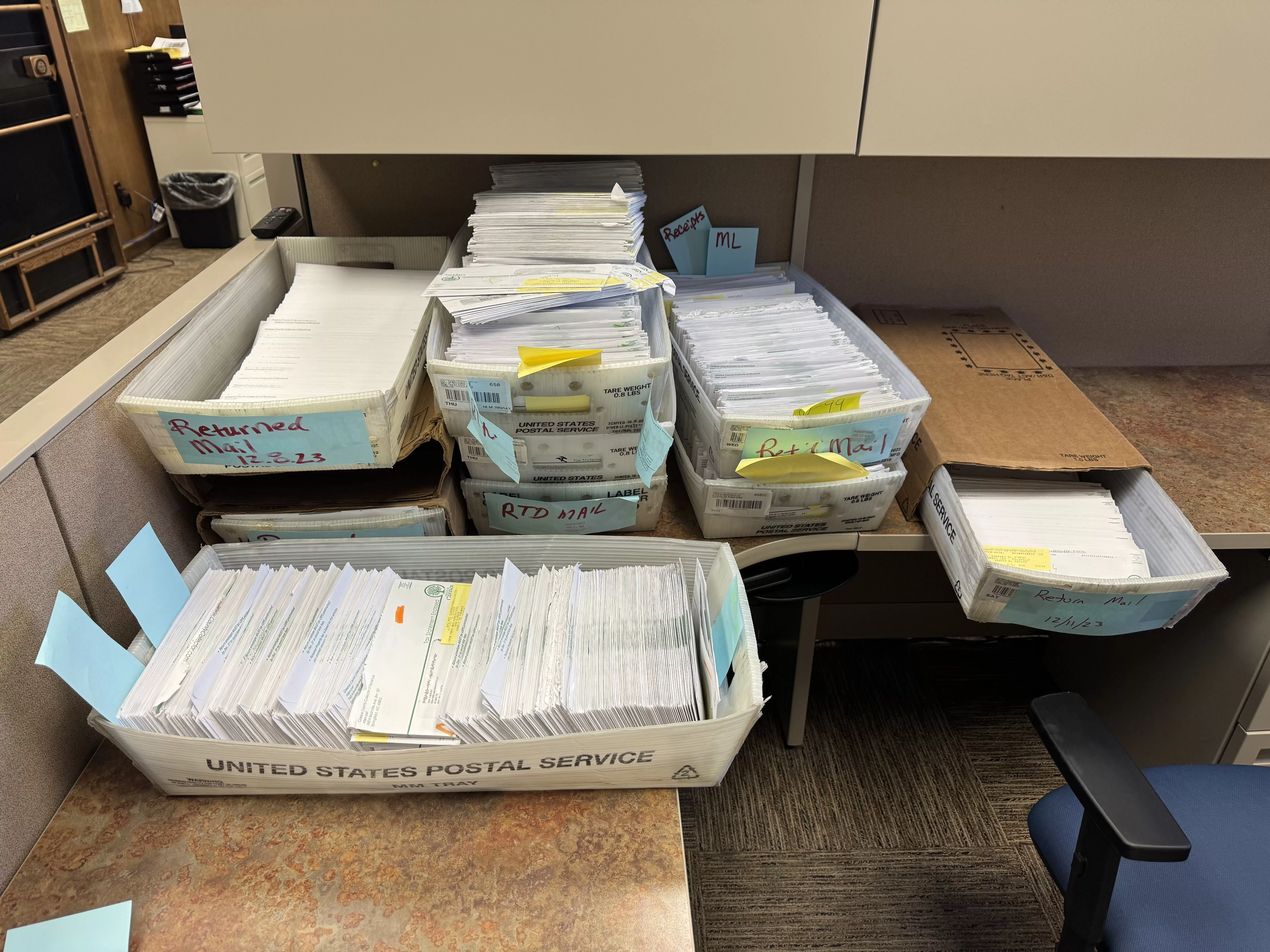

The Greene County Collector’s Office has received thousands of 2023 tax statements that were returned by the U.S. Postal Service (USPS).

The Collector’s Office is required to send those tax statements to the address of record on file with the Greene County Assessor.

But if you move and don’t update that address, you won’t get your taxes in the mail.

The deadline to pay your taxes without penalty is approaching fast.

Greene County 2023 personal property and real estate taxes are due by midnight on Dec. 31.

The last day to pay in person at the Greene County Historic Courthouse in Springfield is Friday, Dec. 29 at 5:00 p.m.

If you haven’t received your tax statement, ontact the Collector’s Office by either emailing collectorhelp@greenecountymo.gov or calling 417-868-4036.

Press Release

Greene County Collector of Revenue, Allen Icet, is alerting citizens that his office has received thousands of 2023 tax statements that were returned back to the county from the U.S. Postal Service (USPS).

The primary reason is due to the incorrect address of the citizen. The Collector’s Office is statutorily required to send annual tax statements to a citizen’s “address of record” that is filed at Greene County Assessor’s Office.

However, if a citizen has moved and not updated their official address of record, their tax statement will be returned back to the county.

The Collector’s Office is still attempting to determine a citizen’s correct address and contact them but the deadline to pay county taxes is quickly approaching.

Greene County 2023 personal property and real estate taxes are due by midnight on Dec. 31. However, the last day to pay in person at the Greene County Historic Courthouse in Springfield is Friday, Dec. 29 at 5:00 p.m.

If a citizen’s account goes unpaid after that date there will be a late fee penalty and interest charged.

If a citizen did not receive their 2023 Greene County tax statement they’re urged to contact the Collector’s Office by either emailing collectorhelp@greenecountymo.gov or calling 417-868-4036. Due to high call volume nearing the deadline the quickest way to get a response is by email.

As a reminder, citizens can find both their 2023 tax statement and pay their bill online at www.countycollector.com. Everything needed in the process can be found by clicking on the two buttons in the top left corner of the homepage.

This is the most efficient way, there are no lines, no need for stamps and envelopes, and taxpayers will get an instant payment receipt. If a taxpayer needs additional help, they can watch this informational online video.

Additionally, citizens can pay their 2023 bill on the phone by calling 888-523-0054, but only if all back taxes have been previously paid.

While there still is time to mail a check to pay a 2023 tax statement, it must be postmarked no later than Dec. 31 by USPS in order to be counted as on time.

If a taxpayer cannot find an online personal property or real estate tax statement for 2023, has a question about the tax amount, or wants to update their address of record, they will need to contact the Greene County Assessor’s Office, at 417-868-4101 or email assessoronline@greenecountymo.gov.